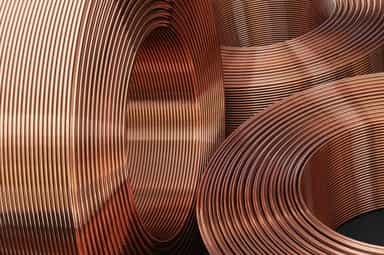

Theme of the Day: China to buy copper for its stockpile

China wants more copper in its state stockpiles, according to a senior metals industry official, a move that would add to upward pressure on prices and highlight a growing push by governments to bolster supply security. The country will expand the size of its strategic copper reserves and also work with major state-owned producers to boost commercial inventories, Duan Shaofu, deputy secretary general of the China Nonferrous Metals Industry Association, said at a press conference. In addition, market experts from the Association also suggested the possibility of adding copper concentrates to the nation’s strategic reserves. China is aware that other countries are also seeking to stockpile key industrial metals, and any move by Beijing could partly be intended as a signal that China is doubling down on its metals supply-chain security. The calls come a day after the US government unveiled “Project Vault” — a planned $12bn fund aimed at building strategic mineral reserves to support domestic production and reduce reliance on Chinese supplies. Last year, the US Geological Survey added copper to its list of minerals that are critical to the American economy and national security. China's State Reserve Bureau (SRB) - part of the National Food and Strategic Reserves Administration - acts as a major, often secretive, purchaser of copper to manage national stockpiles, frequently triggering market price increases, such as in 2022 when it sought to replenish stocks. The SRB has a long track record of buying copper, a strategic metal for China's industrial development but one which the country does not produce enough itself. The SRB aims to ensure supply chain stability for industrial and military needs, and it may increase purchases during periods of low, tempting prices to secure future supply, often boosting imports during market downturns. In the first 50 years of its history, the SRB was able to fulfil its vital but mundane role of stockpiling critical raw materials such as copper discreetly and without attracting much attention outside of the markets it bought from. In 2005, the SRB revealed a massive 1.3Mt stockpile after a trading scandal. It released 80kt of copper into the global market amid rapidly rising copper prices. Moreover, the bureau occasionally rotates its holdings, meaning older metal is sold even while newer material is arriving. While China is not exceedingly secretive about stockpiling “non-strategic” minerals in which China has ample domestic production, like aluminium, it is secretive in stockpiling “strategic” minerals like copper, in which its domestic demand exceeds domestic production. Broadly, five stockpiling indicators can be observed: direct stockpiling, government tenders, leaked information, industry reports, and evidence of other market indicators like spiking imports. However, discerning when China is stockpiling and its reasons for doing so is increasingly challenging given China’s increasing secrecy about mineral-related information. China is an opportunistic player in the copper market, buying at the lows or on dips, but also sells into price rallies.