Daily metals

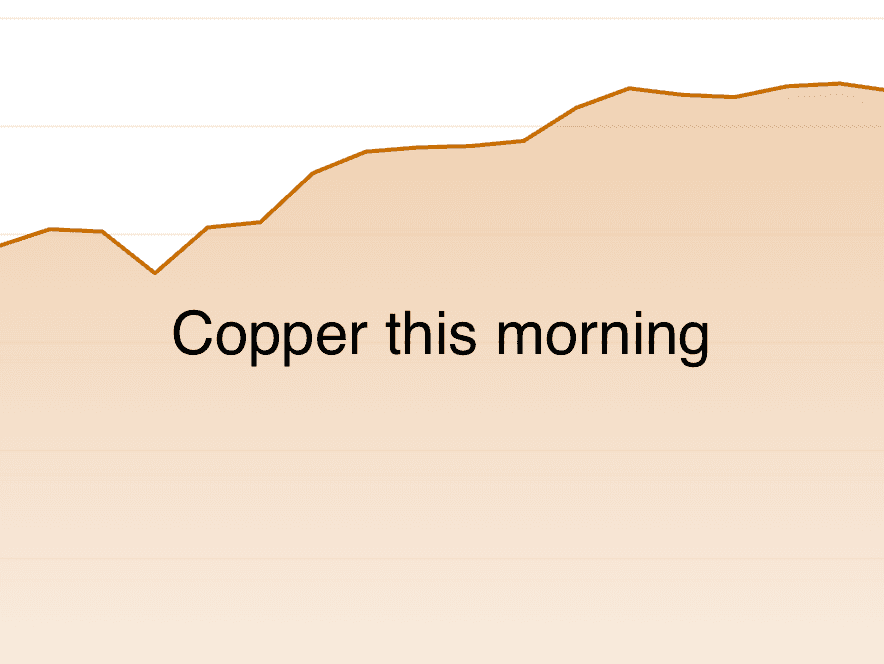

What's Moving Markets?Global equities fell as the recent AI-driven rally showed signs of fatigue and investors digested a fresh batch of corporate earnings. Adding to the cautious mood, several Wall Street chief executives including those from Morgan Stanley and Goldman Sachs, warned at a summit in Hong Kong that markets may be due for a significant correction. It’s been a very good Q3 earnings season so far. Through Friday, revenue growth at S&P 500 companies has averaged 8% and earnings growth is 11%, according to FactSet. Renewed supply side issues helped push energy markets higher. Industrial metals were mixed as supply tightness was offset by concerns over weaker economic data. Yields on 10-year US Treasuries fell by 3bp to 4.09%, while the USD index was 0.2% weaker at 100.1.Precious metals were weaker as the USD reached a three-month high after FOMC members stopped short of endorsing another rate cut next month, extending the ongoing consolidation phase. The Bloomberg Dollar Index has now reached a three-month high, adding some additional downward pressure during the current consolidation phase. Meanwhile, traders readjust their Fed rate cut bets for Dec, following a series of mixed comments from Fed officials. Governor Lisa Cook noted that the risk of further labour-market weakness outweighs that of renewed inflation but refrained from explicitly supporting another rate cut, echoing recent comments from Mary Daly and Austan Goolsbee. Markets now imply a 65% chance of a cut in Dec, down from over 90% a week ago. Central banks reported net purchases of gold totalled 39t in Sep. This buying was up 79% m/m and is the highest month of reported net buying in 2025 so far. Serbia is looking to increase their gold reserves to at least 100t by 2030, up from 52t currently.Investment buying help base metals defy USD strength and poor PMI data. Codelco said its own output in the nine months to Sep totalled 937kt, up 2.1% from the same period last year. The production increase was achieved despite an accident on 31 Jul at its flagship El Teniente mine - Codelco's most profitable operation - which forced a temporary halt to mining and smelting. CEO Ruben Alvarado said that Codelco expects to have more conclusive information about the accident by the end of the year. The global aluminium market remains in deficit, but new capacity from Indonesia could cap further upside. China’s aluminium demand is expected to ease to 2.3%, reflecting slower growth in construction and consumer durables, yet a likely drop in production remains the key. China’s state-backed non-ferrous metals industry association (CNMIA) is recommending aluminium-style capacity caps for the country's copper, lead, and zinc smelters. Chinese processing capacity in all three metals has grown far faster than mine capacity, creating a raw materials crunch that is biting into smelter margins.Iron ore prices were steady. The prospect of China weathering the trade war with the US better than was expected appears to have boosted the confidence of steel mills to start restocking in recent months. Oct imports are forecast to reach 113Mt, based on ship tracking data from Kpler.

Similar articles

Theme of the Day: Gold breaks records as investors seek shelter from market turbulence

Thema des Tages: Gold bricht Rekorde, da Anleger Schutz vor Marktturbulenzen suchen

Gold reclaims $4,000/oz level as dollar slips, US shutdown woes persist