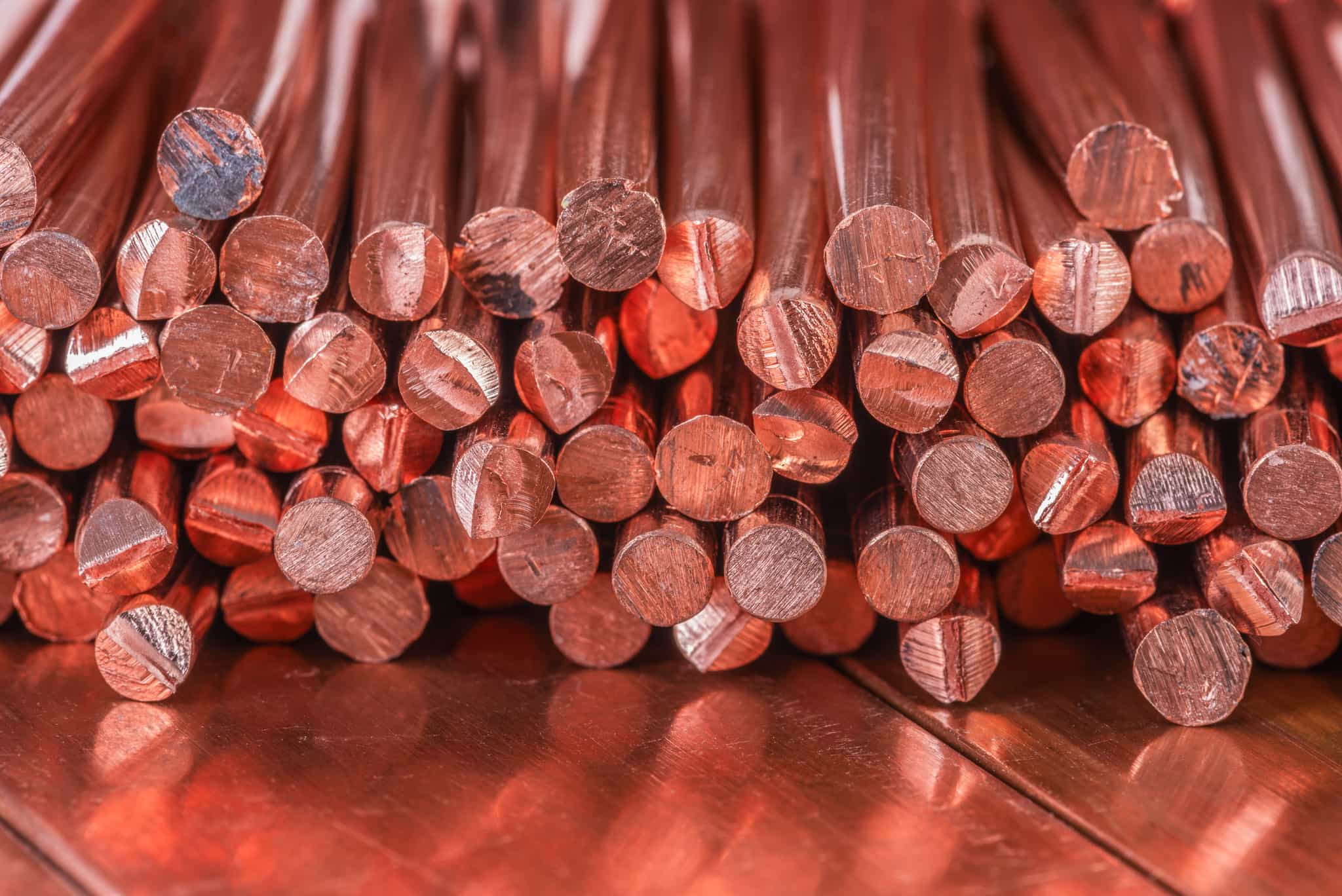

Shanghai copper rises after four-day decline as selling pressure eases

Shanghai copper rose on Thursday after it touched a more than one-week low in the previous session, as selling pressure eased following a four-day decline.

The most-active copper contract on the Shanghai Futures Exchange closed daytime trading rising 1.04% to trade at 86,320 yuan ($12,118.49) per metric ton.

The benchmark three-month copper future on the London Metal Exchange also gained, up 0.75% to $10,777.50 a ton as of 0744 GMT.

Copper's consolidation suggested an "unwinding of overextended positions rather than a shift in the fundamental narrative", analysts at Sucden Financial said in a note.

The red metal's price was still underpinned by mine supply concerns in the coming year of 2026, in which analysts see a potential deficit.

Selling pressure on the Shanghai contract eased after a four-day decline since the metal touched a historic high at 89,270 yuan a ton.

The day's gain was in line with the London benchmark, which also rose after a four-day loss after it touched a record high of $11,200 last week on tight global supply.

Traders now await further economic data from China where the October manufacturing PMI disappointed. Trade readings are expected on Friday and lending data is scheduled for next week.

Among the SHFE base metal complex, aluminium posted the biggest gain, up by 1.31% to 21,630 yuan a ton.

The benchmark three-month aluminium also rose, up by 0.84% to $2,874 a ton, also the biggest gainer among LME base metals as of 0744 GMT.

Funds turned bullish on aluminium as supply concerns shimmered, with aluminium capacity in China, the biggest producer, running up against a capacity cap set by government at 45 million tons per year. Among other SHFE metals, tin gained 0.49%, zinc was up 0.29%, lead lost 0.40%, nickel was little changed.

Elsewhere among LME metals, zinc rose 0.66%, nickel moved 0.40% higher, tin rose 0.62%, while lead ticked up 0.15%.