What's Moving Markets?

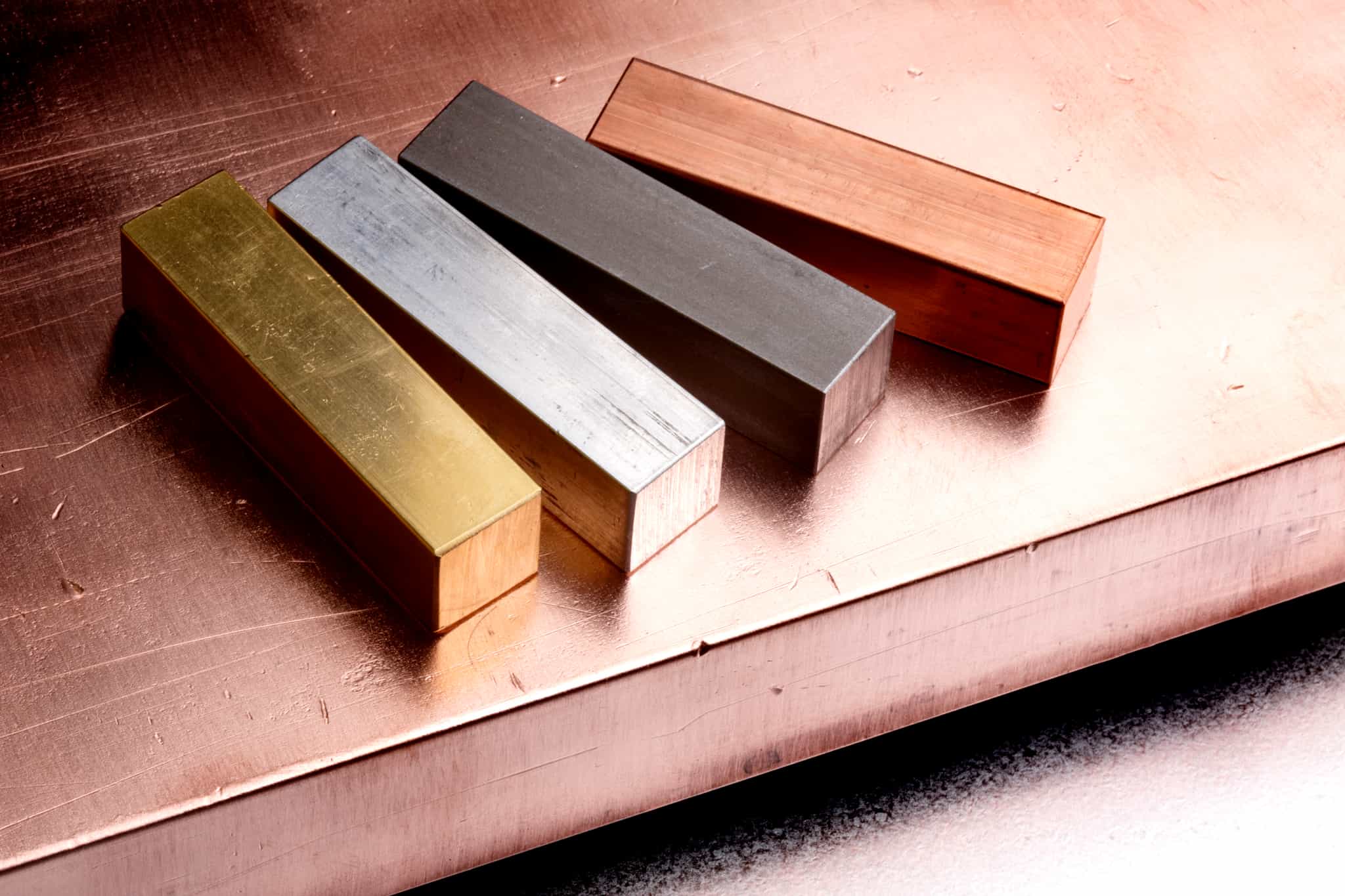

What's Moving Markets?Global stocks closed sharply higher, amid expectations of another rate cut by the Fed this year and the potential of a ceasefire between Ukraine and Russia. Progress on peace talks between Russia and Ukraine weighed on energy and precious metal markets. Industrial metals gained amid signs of tightness. Yields on 10-year US Treasuries were unchanged at 4.00%, while the USD index was steady at 99.6.‘Fomo’ is driving ‘stretched’ US tech valuations, ECB warns: Valuations of US tech stocks such as Nvidia, Alphabet, Microsoft and Meta have become “stretched” as investors are driven by “fears of missing out,” the ECB said. The warning, in the ECB’s latest Financial Stability Review, follows similar cautions from institutions including the IMF and the Bank of England about high valuations of artificial intelligence stocks. “Current market pricing does not appear to reflect persistently elevated vulnerabilities and uncertainties,” the ECB said. Since the temporary sell-off in April over US President Donald Trump’s trade tariffs, markets had been driven by a “renewed risk-on sentiment” that had pushed “already high valuations even higher,” the ECB said in the review. It added that investors were either hoping that “tail risks will not materialise” or were being driven by “fears of missing out on a continued rally.” The ECB pointed to “increasing market concentration” amid “persistently high valuations.” This could result in “sharp, correlated price adjustments” if investors were caught out by negative surprises, it said.Precious metals rallied on rate cut expectation. Expectations for a Dec Fed rate cut have continued to climb and stand above 80%, supported by soft economic data and dovish comments from Fed officials. Reports from Bloomberg that White House National Economic Council Director Kevin Hassett is the leading contender for the next Fed chair, a choice investors view as aligned with President Trump’s push for lower rates, also lifted sentiment. Gold had been under pressure earlier in the session following progress in the Russia-Ukraine peace talks, which hampered haven buying. Silver outperformed, with the gold:silver ratio fell to 78.5. National Bank of the Kyrgyz Republic data showed that its gold reserves increased by almost 2t in Oct. YTD net purchases are now 4t, with total gold holdings rising to 42t. The World Platinum Investment Council’s (WPIC) latest quarterly report forecasts a substantial 2025 supply deficit of 692koz, roughly 9% of annual demand.Base metals ended higher on risk-on appetite in-line with higher equities and a potential of a ceasefire between Ukraine and Russia. There is a stronger downside risk for the USD in the coming days, from weakening macroeconomic data, which should help support the entire complex. However, sustained rallies also remain elusive, as any sharp gains are quickly erased by profit-taking before the end of the day. Copper leads sentiment, buoyed by news that Chilean producer Codelco plans to more than triple its premium to Chinese customers. Codelco is pushing for a premium of $350/t over LME prices for 2026 annual contracts, up from only $89/t agreed to for this year. The higher fee reflects renewed competition as traders position themselves for potential US tariffs. The US is said to be revisiting plans for duties early next year. Tightness in the copper market is becoming more evident at the front end, with the cash-to-3-month spread tightening to $34/t backwardation.Iron ore gained as state media in China suggested Beijing is considering measures such as providing new homebuyers mortgage subsidies, raising income tax rebates for mortgage borrowers, and lowering home transaction costs in an effort to stabilise its ailing property sector. This also garnered some buying in the iron ore market, despite data showing that China’s finished steel production fell 4.5% m/m in Oct to 118.63Mt.