Daily metals

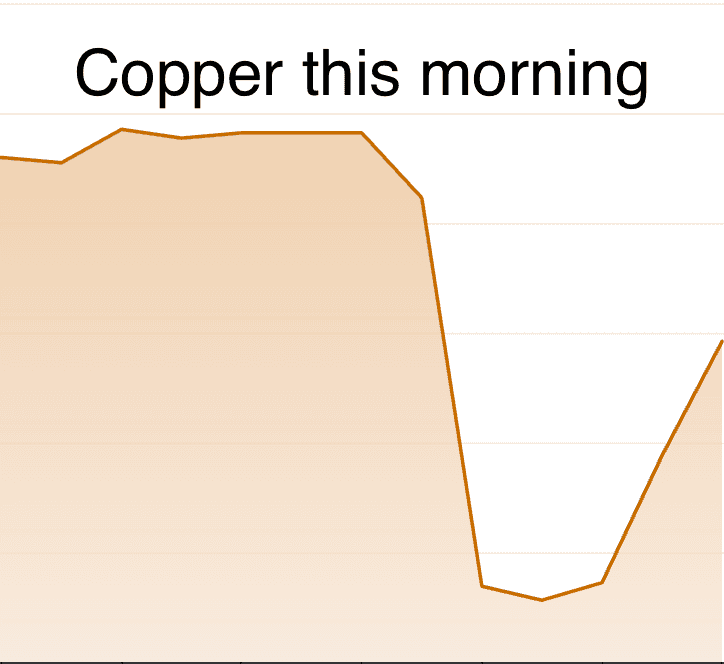

What's Moving Markets?Global equities rallied as investors looked past hawkish Fed minutes and the government shutdown to continue to embrace the AI trade. Meanwhile, the ongoing government shutdown continues to delay the release of key economic data. Even so, traders remain confident that the Fed will cut rates twice more this year. Energy markets were mixed with conflicting signals on demand and supply. Gold touched $4,000/oz amid strong investor demand. Yields on 10-year US Treasuries rose by 3bp to 4.15%, while the USD index was 0.5% stronger at 99.4.Ahead of LME Week which begins on Monday, consensus has turned more bullish on both copper and tin, arguing that the market is starting to look beyond short-term demand worries and towards a tighter supply picture. There is a growing sense that industrial metals are on a firmer footing as the global economy steadies and the supply side tightens. A combination of energy transition spending and recovering industrial activity and slowing mine supply are supportive factors. Is it the start of a new metals supercycle? The supercycle in metals is a period in which the prices of major commodities such as metals continue to increase over a long period of time. At this time, not only are the precious metals (such as gold and silver) performing well, but the base metals (such as copper and zinc) are also performing well. What’s driving this? Global economic changes, huge investments in clean energy, and an increase in infrastructure spending across the world. These trends are increasing the demand, and supply is restrictive and challenging. Macro headwinds may well cap the upside and LME Week will provide a good way to take the pulse of the market. Is bullish optimism warranted?A bout of profit-taking pressured the precious metals in a much overdue and needed correction amid a stronger USD. This coincided with the return of Chinese traders following their week-long holiday. Spot silver surged to an all-time high of $51, surpassing its previous peak recorded during the Hunt brothers’ squeeze in 1980, as strong safe-haven demand met tight supply. A shortage of freely available silver in the London market has further supported prices. With applications ranging from investment to industrial uses — such as solar panels and wind turbines — silver demand is projected to exceed supply for the fifth consecutive year in 2025. Dip buying should support both gold and silver as the correction continues. The coming days will reveal whether this is third time lucky, or if $50 once again becomes a major ceiling. Latest data from the IMF shows that the Central Bank of Brazil increased its gold reserves by almost 16t in Sep - its first addition of gold since Jul 2021. Its gold holdings now total 145t.Base metals have jumped 3–4% during China’s Golden Week, while SHFE prices rose, the first trading day after participants returned from the Golden Week holiday. Copper has edged towards the $11,000 level and remains well supported, driven by strong investor appetite for metals, the return of Chinese traders after Golden Week, and ongoing supply disruptions at Freeport’s massive Grasberg mine in Indonesia. Teck Resources cut its output projection to 170–190kt this year from previous guidance of 210–230kt. It also reduced annual targets for the coming three years. This follows a series of supply disruptions that have eroded the market’s confidence of any further growth in supply. The tightening conditions are clearly reflected in the LME forward curve, which over the past month has flipped from contango — signalling ample supply — to backwardation, indicating growing tightness.Iron ore remained stuck in a tight range. Concerns grow over further efforts to limit China’s steel exports. European officials are proposing a lower quota on steel imports that don’t attract tariffs. At the same time, it would double the tariff on steel imports above that quota to 50%. China accounts for 37% of the EU’s steel imports.